In today’s fast-moving business climate, it’s easy to get trapped chasing short-term targets—after all, payrolls must be met, bills must be paid, and shareholders often judge performance by quarterly results. However, focusing exclusively on immediate wins can harm an organization’s long-term strategic positioning, limiting innovation and eroding competitive advantage over time.

The central challenge is balancing the need for positive cash flow and profitability today with the need to invest in the future—through research and development (R&D), staff training, strategic partnerships, and technology upgrades. For business owners and executives, deciding how to navigate this delicate dance can be the difference between short-lived success and a thriving, future-proof organization.

This article outlines practical tools and strategies to help you bridge the gap between short-term pressures and long-term growth ambitions—so you can build a resilient business that excels both now and in the future.

Table of Contents

ToggleWhy This Balance Matters

- Sustainability: Overemphasizing quick wins can reduce resources available for innovation and growth projects. Over time, a lack of product evolution or technological advancement can result in loss of market share.

- Brand and Reputation: A short-sighted focus might compromise service quality or lead to cost-cutting measures that alienate customers and talent. Maintaining a strong brand identity requires consistent investments in people, culture, and customer experience.

- Employee Retention: Top talent seeks growth opportunities, challenging projects, and a sense of stability. If all efforts revolve around meeting next month’s targets, employees may grow frustrated with the lack of long-term vision and leave.

- Investor Confidence: Savvy investors look beyond next quarter. They analyze the company’s pipeline of innovation, market expansion plans, and leadership vision. A robust long-term strategy can bolster investor trust and stability.

Common Pitfalls to Avoid

- Excessive Short-Term Mindset

- Risk: Neglect of innovation, market shifts, and emerging technologies.

- Solution: Establish clear guardrails on how much time, money, and leadership attention is devoted to immediate revenue vs. future-oriented projects.

- Overinvestment in Long-Term Projects

- Risk: Cash flow shortages and budget overruns that undermine current profitability.

- Solution: Pilot or phase large initiatives, validating assumptions before fully committing resources.

- Misaligned Metrics

- Risk: Using only near-term financial metrics like quarterly profit margins can discourage strategic spending.

- Solution: Balance these with customer-centric, brand equity, and employee engagement metrics to get a fuller picture of performance.

1. Introduce a Priority Matrix

A Priority Matrix helps categorize initiatives based on their impact and time horizon. Think of it as a two-dimensional grid with the axes representing (1) the time-to-impact and (2) the strategic value.

- Quick Wins:

- Characteristics: High impact, shorter time frame (e.g., small tweaks to your sales funnel, pricing adjustments, or short-term promotions).

- Action: Allocate resources to capitalize on low-hanging fruit that can generate immediate cash flow.

- Long Plays:

- Characteristics: Significant impact, longer time frame (e.g., major R&D initiatives, building new product lines, strategic partnerships).

- Action: These require consistent investment and milestones to measure progress. Track these efforts in a project management system to ensure accountability and maintain momentum.

- Must-Dos:

- Characteristics: Essential to operations or compliance, regardless of time frame (e.g., regulatory measures, security upgrades, mandatory training).

- Action: Budget for these non-negotiables first, ensuring they don’t starve growth-oriented projects of necessary resources.

How to Use the Matrix

- List All Initiatives: Brainstorm every current and proposed project—small or large.

- Categorize Them: Place each project in the appropriate quadrant (Quick Win, Long Play, Must-Do).

- Assign Owners and Deadlines: Each initiative should have a dedicated lead and clear milestones.

- Review Regularly: Reevaluate quarterly or semi-annually; priorities can shift rapidly due to market changes or new insights.

2. Track the Right Metrics

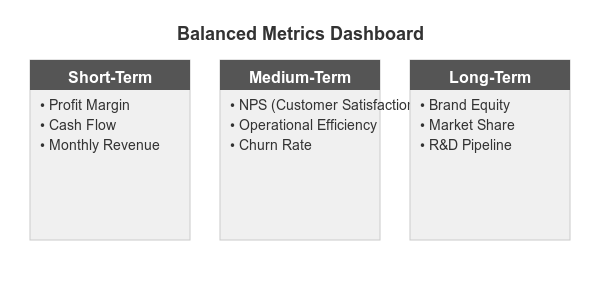

Measuring success through balanced metrics is crucial. If you only use short-term KPIs, your organization will inevitably skew toward immediate gains at the expense of the future. Conversely, if you only use long-range measures, you risk cash flow problems and losing ground to competitors right now.

Below are some core metric categories to monitor:

- Financial Performance (Short-Term)

- Examples: Profit margin, cash flow, revenue growth rate.

- Role: Ensures you’re meeting current obligations and have the liquidity to operate.

- Customer-Centric KPIs (Medium to Long-Term)

- Examples: Net Promoter Score (NPS), Customer Lifetime Value (CLV), brand awareness.

- Role: Indicates customer loyalty and market positioning, which fuels sustainable revenue over time.

- Innovation Metrics (Long-Term)

- Examples: Percentage of revenue from new products, R&D spend as a percentage of revenue, time-to-market.

- Role: Encourages ongoing investments in future-facing initiatives, monitoring the health of your innovation pipeline.

- Operational Efficiency (Short- to Medium-Term)

- Examples: Average delivery time, conversion rates, churn rate.

- Role: Measures how efficiently current processes are operating, which can free up resources for growth.

- People Metrics (Short, Medium, and Long-Term)

- Examples: Employee engagement scores, turnover rates, internal promotion frequency.

- Role: Indicates workplace culture health, skill development, and leadership potential—all critical for future success.

Combining Metrics for a Holistic View

- Monthly or Quarterly Dashboard: Create a visual dashboard that integrates short-term indicators (e.g., monthly revenue) with at least one or two medium- or long-term metrics (e.g., new product adoption, brand sentiment).

- Regular Team Reviews: Encourage cross-functional teams (Finance, Marketing, Operations, Product Development) to review these metrics together. This collaboration prevents siloed decision-making and fosters a culture that values both present and future.

3. Budget Allocation Guidelines

One of the most direct ways to balance short- and long-term objectives is through thoughtful budgeting. If you fail to allocate funds proactively for long-term projects, they’ll be perpetually sidelined for immediate issues.

Approaches to Consider

- 70-20-10 Rule

- What It Means: Allocate 70% of your budget to core business operations (short-term), 20% to mid-range innovations, and 10% to high-risk or long-term bets.

- Why It Works: Originating from Google’s model, this approach ensures continuous improvements in current products while fostering big leaps in innovation.

- Annual vs. Quarterly Flexibility

- Annual Budget for Big Initiatives: Plan out major investments—like R&D or major technology upgrades—on an annual basis for better forecasting.

- Quarterly Adjustments: Fine-tune short-term spending each quarter to respond to market shifts or unexpected events.

- Create a ‘Future Fund’

- What It Means: Set aside a dedicated portion of revenue (e.g., 5–10%) specifically earmarked for long-term innovation.

- Why It Works: This buffer ensures future-focused initiatives are not deprioritized when short-term pressures arise.

- ROI Threshold for Projects

- Rule: Each proposed project, whether short- or long-term, should outline its potential Return on Investment (ROI) over a specified period.

- Implementation: Use different ROI expectations: for short-term projects, the threshold might be met in 6–12 months; for long-term projects, an ROI view of 24–36 months or more is acceptable. This helps leadership understand where and why certain investments are being made.

Putting It All into Practice: A Step-by-Step Guide

- Conduct an Internal Assessment

- Collect data on current projects, costs, and returns. Involve department heads to ensure a 360-degree view.

- Identify immediate revenue-driving activities and any ongoing long-term initiatives.

- Build or Revise the Priority Matrix

- List all potential projects, categorize them, and ensure each has clear owners and KPIs.

- Spot any imbalance: Is your list loaded with short-term tasks, leaving little room for game-changing innovations?

- Define Balanced KPIs

- Select one to two crucial metrics per category (financial, customer-centric, innovation, operational efficiency, and people).

- Build a weekly, monthly, or quarterly dashboard. Make sure to communicate these metrics transparently across teams.

- Allocate Budgets Accordingly

- Decide on a framework (e.g., 70-20-10) or a “Future Fund” approach.

- Incorporate quarterly reviews to redistribute funds if market conditions shift or projects underperform.

- Review, Learn, and Iterate

- At least twice a year, review your entire portfolio of initiatives. Which quick wins succeeded, and which long plays are meeting milestones?

- Rebalance as necessary. It’s normal to pivot if a long-term project faces unforeseen hurdles—or to double down if early indicators are promising.

- Foster a Culture of Balance

- Leadership must model this mindset by discussing both immediate successes and progress toward long-term goals in company-wide updates.

- Encourage teams to surface innovative ideas, even if they’re not immediately profitable. Recognize and reward both short-term execution and long-term vision.

Conclusion

Balancing short-term gains with long-term growth is neither a fixed formula nor a one-time exercise; it’s an ongoing discipline that requires strong leadership, transparent metrics, and a supportive culture. By utilizing a Priority Matrix to categorize projects, tracking a balanced set of KPIs, and strategically allocating budgets, businesses can ensure they don’t sacrifice tomorrow’s opportunities on the altar of today’s demands.

Ultimately, the best way to protect your organization’s future is to invest in it continually—while never losing sight of the present. When companies effectively marry immediate profitability with innovative, forward-thinking strategies, they set themselves up for sustainable success in a world where both agility and endurance are paramount.